Understanding the PPP Workforce Reduction Rules After the August 4th, 2020 FAQs

The most important aspect of the Paycheck Protection Program is a borrower’s ability to have their loan forgiven if they meet certain criteria. Under the CARES Act, which created the PPP, one of those criterion was that, during their loan coverage period, the borrower had to maintain the same workforce levels they had prior to February 15, 2020. After all, the whole point of the PPP was to keep workers employed throughout the COVID crisis. Borrowers who didn’t maintain their workforce hours (or FTE as it is known in the PPP world) would have a pro rata reduction in forgiveness unless they met one of the six exceptions provided by the rules.

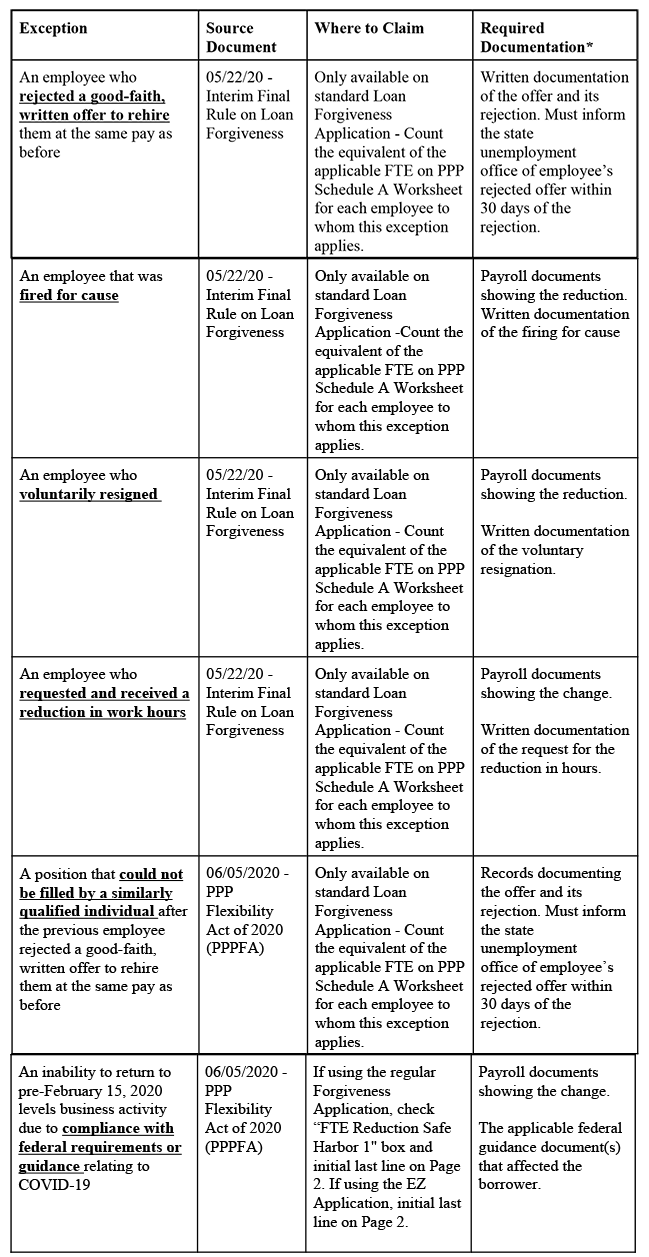

The SBA introduced the four original exceptions in an Interim Final Rule released on May 22nd. The PPP Flexibility Act of 2020, which was enacted on June 5th, created two new exceptions, the most notable of which provides that a reduction in workforce hours that is the result of an effort by the borrower to comply with federal COVID related health laws or guidelines will be excused from any reduction in forgiveness associated therewith. It is important to note that this is the only exception that can be used in the EZ Forgiveness Application, which does not require any detail or calculations as to this exception on the Application itself.

What You’ve Been Told About Scaling… Is Wrong.

Freedom is not found in hustle, hacks, or grinding harder. It’s found in building a business that runs without you.

Download The Untold Business Scaling Blueprint and Discover:

Furthermore, on August 4th, 2020, after over a month of silence regarding PPP guidance, the SBA issued 23 new Frequently Asked Questions and Answers, a number of which provided guidance on workforce reductions and how they would affect a borrower’s forgiveness. As borrowers proceed through their covered periods they are often finding themselves in workforce reduction scenarios that are quite specific to their business, but how those scenarios should be treated for forgiveness purposes can be ambiguous under the current rules. The August 4th guidance will be discussed in greater detail later in this article.

The chart below summarizes the key characteristics of each exception as of August 4th, 2020:

*Borrowers are required to maintain, but not necessarily submit, all of the above required documentation. Borrowers must maintain such required documentation for 6 years following forgiveness of the loan.

Given the circumstances of many borrowers who reduced workforce hours, this new exception for compliance with government health guidelines will be an important “get out of jail free card”.

Here is what we know about how to determine whether a workforce hours reduction can be considered to have been attributable to federal health guidelines so far:

Thousands of borrowers who took PPP loans but were subsequently compelled to close or limit business operations in compliance with government orders were left wondering “what about us?”

A looming question for PPP borrowers once local governments and states began to hand down shutdown orders was how will this affect my PPP loan? How is a business supposed to spend their loan proceeds appropriately and avoid reducing their workforce hours if the state orders them to close up shop during their covered period? Surely, these borrowers could not be punished. Their workforce reductions were not their own doing. Rather, it was the government’s.

The enactment of the PPP Flexibility Act of 2020 on June 5th began to address this question by stating that businesses would not be punished for a reduction in FTEs due to compliance with requirements or guidance issued by the CDC, HHS, or OSHA, but did not address compliance with local or state-issued shutdown orders. This glaring omission in the exception rules was addressed by the June 22nd Interim Final Rules which states that since state and local government orders are based in part on guidance from the three federal agencies mentioned above, that those who were forced to reduce their workforce hours in compliance with government orders and guidelines would also not be penalized. The June 22nd Interim Final Rules are discussed in more detail below.

The applicable language of the Act is as follows:

During the period beginning on February 15, 2020, and ending on December 31, 2020, the amount of loan forgiveness under this section shall be determined without regard to a proportional reduction in the number of full-time equivalent employees if an eligible recipient, in good faith is able to document an inability to return to the same level of business activity as such business was operating at before February 15, 2020, due to compliance with requirements established or guidance issued by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration during the period beginning on March 1, 2020, and ending December 31, 2020, related to the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID–19.

How does this new exception apply to borrowers?

Though the language above is short, there is much information to be analyzed and understood.

First, the period for which this exception applies is only from February 15th to December 31st.

At the time that new exception was released some interpreted the rules to mean that borrowers seeking to claim the exception would need to wait until after December 31st to file for forgiveness.

Fortunately, the SBA has since announced that borrowers may file for forgiveness any time after their loan proceeds have been properly spent. This fixed time period also means that borrowers who got their loan early and finished their covered period before June 5th (when the exception was created) can retroactively claim the new exception if they have not filed for forgiveness yet.

The exception states that businesses must be unable to return to “the same level of business activity” that they were operating at prior to February 15th. While “business activity” has never been explicitly defined, we can safely assume it is likely to be by reference to the borrower’s total employee hours or other appropriate unit of measurement. This is because the Flexibility Act says a “reduction in the number of full-time equivalent employees” will be excepted from loan forgiveness reductions if this exception is claimed. This is opposed to an interpretation of “same level of business activity” that would be more related to sales, units manufactured, or some other indicator.

The fact that borrowers can only cite to guidance issued during the period from March 1st to December 31st as evidence of compliance with government guidelines creates an interesting paradox. This is because borrowers must maintain their workforce as of before February 15th while the exception states that a borrower can only cite to guidance issued after March 1st as evidence of compliance with government guidelines. In effect, this could mean that any workforce reduction that occurred between February 15th and March 1st cannot be disregarded under this new exception, but that does not seem to be what was intended, so this 14 day gap will probably be ignored by most applicants.

This new exception doesn’t ask much of a borrower seeking to claim it – only that they are able to, “in good faith,” document their inability to operate at the pre-February 15th level. But what exactly does that mean? For one, we know that borrowers can only claim an inability to operate as it pertains to “the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID–19.” Since borrowers are required to “document” their inability to operate, this likely means that they will be required to produce evidence of the amount of workforce hours that were eliminated as well as the borrower’s reason for doing so. For example, a borrower’s attestation that they had to reduce their workforce “because of social distancing” will not be sufficient. Instead, a borrower could document that g iven “the confined dimensions of the workspace and the recommended 6 foot distance between individuals in this setting, it would be impracticable to maintain the same number of employees and shift rotation schedule.”

State Law Indirectly Applies.

Finally, as is a standard pattern with PPP guidance, the apparently not so thoroughly thought out creation of this exception led to even more questions. The Act states that a borrower who complies with CDC, HHS, or OSHA guidelines may claim the new exception. This limitation appeared to leave borrowers who shut down or reduced their operations in compliance with state or local guidelines out in the cold.

The SBA addressed this lingering issue in the Interim Final Rule on Revisions to Loan Forgiveness Interim Final Rule released on June 22nd by allowing State law required close-downs to qualify.

What Does the Interim Final Rule Issued on June 22 Mean for Borrowers?

The new June 22nd Interim Final Rule provides as follows:

Borrowers are also exempted from the loan forgiveness reduction arising from a reduction in the number of FTE employees during the covered period if the borrower is able to document in good faith an inability to return to the same level of business activity as the borrower was operating at before February 15, 2020, due to compliance with requirements established or guidance issued between March 1, 2020 and December 31, 2020 by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention (CDC), or the Occupational Safety and Health Administration related to the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID–19 (COVID Requirements or Guidance). Specifically, borrowers that can certify that they have documented in good faith that their reduction in business activity during the covered period stems directly or indirectly from compliance with such COVID Requirements or Guidance are exempt from any reduction in their forgiveness amount stemming from a reduction in FTE employees during the covered period. Such documentation must include copies of applicable COVID Requirements or Guidance for each business location and relevant borrower financial records.

The Administrator, in consultation with the Secretary, is interpreting the above statutory exemption to include both direct and indirect compliance with COVID Requirements or Guidance, because a significant amount of the reduction in business activity stemming from COVID Requirements or Guidance is the result of state and local government shutdown orders that are based in part on guidance from the three federal agencies.

Further, according to the CDC, their guidance is “meant to supplement – not replace – any state, local, territorial, or tribal health and safety laws, rules, and regulations with which businesses must comply.”

It appears that the key to successfully claiming the exception for compliance with government health guidelines will be proper documentation. This makes sense since a great many borrowers reduced their workforces in order to stay compliant with CDC guidelines. But what exactly does proper documentation entail? The June 22nd Interim Final Rule specifically states, “[proper] documentation must include copies of applicable COVID Requirements or Guidance for each business location and relevant borrower financial records.”

Not only will borrowers be required to cite to the specific guidance document that their action was in compliance with, but they will also be required to produce applicable financial records, which will likely include payroll statements.

It may also be best practice for a borrower to document each step taken towards maintaining compliance with the guideline they are relying upon. For example, a borrower that reduced hours of operation might consider attaching an addendum to their forgiveness application that states “in compliance with CDC Guideline #1234, which suggests limiting a business’s hours of operation to daylight hours only, Borrower has taken the necessary steps to adjust its’ hours of operation and has reduced its’ workforce by 10% to account for the reduced hours of operations.”

One more item of note is the fact that there doesn’t seem to be a time requirement for compliance with requirements or guidance issued. If this is the case, a borrower that was shut down for only a short-time by say a “shelter in place order” from its local government may be able to claim this exception for the entire Covered Period. While it remains unknown if the SBA would accept this method for claiming the exception, there hasn’t been any indication they will not. Further guidance from SBA on how to apply this exception would certainly be welcomed.

Borrowers hoping to claim this exception due to state or local government orders should look to the order that affected them to see if that order specifically cites to guidance from the HHS, CDC, or OSHA. When documenting this exception it will be best practice to include the state order, the federal guidance the state order cites to. Tracking down the correct guidance document can prove to be difficult considering that, between the three applicable federal agencies, hundreds of COVID guidance documents have been released since March 1st. Thankfully, all three agencies provide searchable indexes of their guidance documents. Links to those indexes can be found below:

CDC – https://www.cdc.gov/coronavirus/2019-ncov/communication/guidance-list.html?Sort=Date%3A%3Adesc

OSHA – https://www.osha.gov/pls/publications/publication.AthruZ?pType=AthruZ#C

HHS – https://www.hhs.gov/coronavirus/index.html

How to claim this exception on the Forgiveness Applications

It is one thing to qualify for this exception. It is another thing to actually claim it on the correct application when it comes time to file for forgiveness. While each of the exceptions requires a borrower to submit supporting documentation, different exceptions will require different steps from the borrower depending on which forgiveness application the borrower is submitting.

The Forgiveness Application EZ:

Most borrowers that (1) did not reduce the annual salary or hourly wages of any employee by more than 25% during the covered period AND (2) was unable to operate at the same level of business activity as before February 15, 2020 due to compliance with requirements established or guidance issued prior to March 1st can file for forgiveness using the PPP Loan Forgiveness Application Form 3508EZ.

The EZ Application was designed to allow small borrowers and those who knew they would not be subject to forgiveness reductions to quickly and easily apply for forgiveness. This is why a borrower is able to claim the exception for compliance with federal guidelines on the EZ Application. Imagine for a moment that you are a borrower that owns a non-essential business that was ordered to close immediately after you received your PPP loan, and you stayed closed for the remainder of your covered period. Obviously, you likely would not have been able to maintain full employment and you will have reduced your workforce hours. The exception still allows you to obtain full forgiveness in this scenario, assuming that the loaned amount was spent on payroll costs for the employees that you were able to retain or other permitted non payroll costs, but it would be a waste of time to fill out the entire 5 page regular Forgiveness Application which requ ires complex calculations and documentation. Instead, you may claim the exception simply by filling out the EZ Application as required and initialing the last line on Page 2 just before the signature blocks. You will still need to provide the applicable documentation, of course. But claiming this exception on the EZ Application will be as easy as checking a box.

The Standard Loan Forgiveness Application

The claiming the exception on the standard loan forgiveness application operates much the same way that it does on the EZ Application. Again, the borrower will simply be required to initial the last line on page 2 just before the signature blocks. Borrowers will still need to provide all applicable documentation to successfully claim the exception on the standard loan forgiveness application.

Interestingly, a borrower is never asked to perform any calculations in an effort to claim the exception for compliance with federal health guidelines. Instead, on both applications, borrowers are simply required to certify in good faith that they were “unable to operate between February 15, 2020 and the end of the Covered Period at the same level of business activity as before February 15, 2020 due to compliance with [federal health guidelines].” The standard loan forgiveness application does require one additional step which is to check the box near the bottom of page 3 that indicates the borrower qualifies for FTE Reduction Safe Harbor #1.

By only requiring a good faith certification, the SBA has effectively made this an “all-or-nothing” exception. Your reductions are either entirely forgiven or they are not. This is opposed to the other 5 exceptions which require a borrower to calculate and include on the PPP Schedule A Worksheet the FTE of an employee to which the exceptions apply.

How to Account for Workforce Salary Reductions

It is inevitable that workforce reductions that cannot be discounted by the above-mentioned exceptions will occur for some borrowers, especially in scenarios where an employee’s salary or hourly wage was reduced. These types of scenarios are addressed by FAQ #4 under the Loan Forgiveness Reductions FAQs section of the August 4th FAQ release.

Regarding pay reduction’s effects on forgiveness the FAQ states, “If the salary or hourly wage of a covered employee is reduced by more than 25% during the Covered Period or the Alternative Payroll Covered Period, the portion in excess of 25% reduces the eligible forgiveness amount unless the borrower satisfies the Salary/Hourly Wage Reduction Safe Harbor.” Question #4 also provides three extremely helpful examples that illustrate how a borrower should handle pay reductions when it comes to applying for forgiveness.

Example 1: A borrower received its PPP loan before June 5, 2020 and elected to use an eight-week covered period. Its full-time salaried employee’s pay was reduced during the Covered Period from $52,000 per year to $36,400 per year on April 23, 2020 and not restored by December 31, 2020. The employee continued to work on a full-time basis with a full-time equivalency (FTE) of 1.0. The borrower should refer to the “Salary/Hourly Wage Reduction” section under the “Instructions for PPP Schedule A Worksheet” in the PPP Loan Forgiveness Application Instructions. In Step 1, the borrower enters the figures in 1.a, 1.b, and 1.c, and because annual salary was reduced by more than 25%, the borrower proceeds to Step 2. Under Step 2, because the salary reduction was not remedied by December 31, 2020, the Salary/Hourly Wage Reduction Safe Harbor is not met, and the borrowe r is required to proceed to Step 3. Under Step 3.a., $39,000 (75% of $52,000) is the minimum salary that must be maintained to avoid a penalty. Salary was reduced to $36,400, and the excess reduction of $2,600 is entered in Step 3.b. Because this employee is salaried, in Step 3.e., the borrower would multiply the excess reduction of $2,600 by 8 (if it had instead selected a 24-week Covered Period, it would multiply by 24) and divide by 52 to arrive at a loan forgiveness reduction amount of $400. The borrower would enter on the PPP Schedule A Worksheet, Table 1, $400 as the salary/hourly wage reduction in the column above box 3 for that employee.

This particular example is helpful because, previously, many people had interpreted the 25% wage reduction rule to include the entire percentage reduction in wages when calculating the forgiveness reduction as opposed to just the amount of the wage reduction that exceeded the 25% reduction threshold.

Example 2: A borrower received its PPP loan before June 5, 2020 and elected to use a 24-week Covered Period. An hourly employee’s hourly wage was reduced from $20 per hour to $15 per hour during the Covered Period. The employee worked 10 hours per week between January 1, 2020 and March 31, 2020. The borrower should refer to the “Salary/Hourly Wage Reduction” section under the “Instructions for PPP Schedule A Worksheet” in the PPP Loan Forgiveness Application Instructions. Because the employee’s hourly wage was reduced by exactly 25% (from $20 per hour to $15 per hour), the wage reduction does not reduce the eligible forgiveness amount. The amount on line 1.c would be 0.75 or more, so the borrower would enter $0 in the Salary/Hourly Wage Reduction column for that employee on the PPP Schedule A Worksheet, Table 1.

If the same employee’s hourly wage had been reduced to $14 per hour, the reduction would be more than 25%, and the borrower would proceed to Step 2. If that reduction were not remedied as of December 31, 2020, the borrower would proceed to Step 3. This reduction in hourly wage in excess of 25% is $1 per hour. In Step 3, the borrower would multiply $1 per hour by 10 hours per week to determine the weekly salary reduction. The borrower would then multiply the weekly salary reduction by 24 (because the borrower is using a 24-week Covered Period). The borrower would enter $240 in the Salary/Hourly Wage Reduction column for that employee on the PPP Schedule A Worksheet, Table 1. If the borrower applies for forgiveness before the end of the 24-week Covered Period, it must account for the salary reduction (the excess reduction over 25%, or $240) for the full 24-week Covered Period.

This example once and for all clarifies that the 25% reduction rule only applies to reductions in excess of 25%. So long as an employee’s salary is not reduced by more than 25%, the borrower will not have to account for the wage reduction in their forgiveness calculations.

Example 3: An employee earned a wage of $20 per hour between January 1, 2020 and March 31, 2020 and worked 40 hours per week. During the Covered Period, the employee’s wage was not changed, but his or her hours were reduced to 25 hours per week. In this case, the salary/hourly wage reduction for that employee is zero, because the hourly wage was unchanged. As a result, the borrower would enter $0 in the Salary/Hourly Wage Reduction column for that employee on the PPP Schedule A Worksheet, Table 1. The employee’s reduction in hours would be taken into account in the borrower’s calculation of its FTE during the Covered Period, which is calculated separately and may result in a reduction of the borrower’s loan forgiveness amount.

This example is important because it clarifies that the 25% wage reduction rule only applies to actual reductions in wages as opposed to a reduction in total compensation that resulted from a reduction in the employee’s working hours.

The exception for compliance with federal health guidelines is arguably the greatest relief the SBA has provided to borrowers except for forgiveness of the loan itself. At this stage of the COVID crisis it is hard to imagine a business that hasn’t been adversely affected by government shutdown orders or that hasn’t implemented new policies based on federal health guidelines. These FTE exceptions have been referred to as “get out of jail free cards” by expert advisors so it is curious that the SBA is so willing to apply this exception to such a broad swath of borrowers with very few mechanisms in place to ensure that borrowers are not claiming the exception in bad faith. After following the evolution of the PPP for months you would have to forgive someone if they came to believe that the SBA and the Treasury have adopted the attitude of “welp, the money has already been allocated. We may as well just forgive as m any of these loans as possible.”

As we hurdle to the month of August with no timetable for the much anticipated end of the COVID crisis, now is the time for Congress to come together and finalize the next COVID relief package. We hope that through this arduous process of creating and amending the PPP program, the SBA and the Treasury will have learned some valuable lessons and will be ready to implement an efficient and effective PPP 2.0 sometime in the near future. Until then, stay tuned for future updates.